Unknown Facts About Feie Calculator

Wiki Article

6 Easy Facts About Feie Calculator Described

Table of ContentsLittle Known Facts About Feie Calculator.Little Known Facts About Feie Calculator.Our Feie Calculator PDFsNot known Details About Feie Calculator The Best Strategy To Use For Feie Calculator

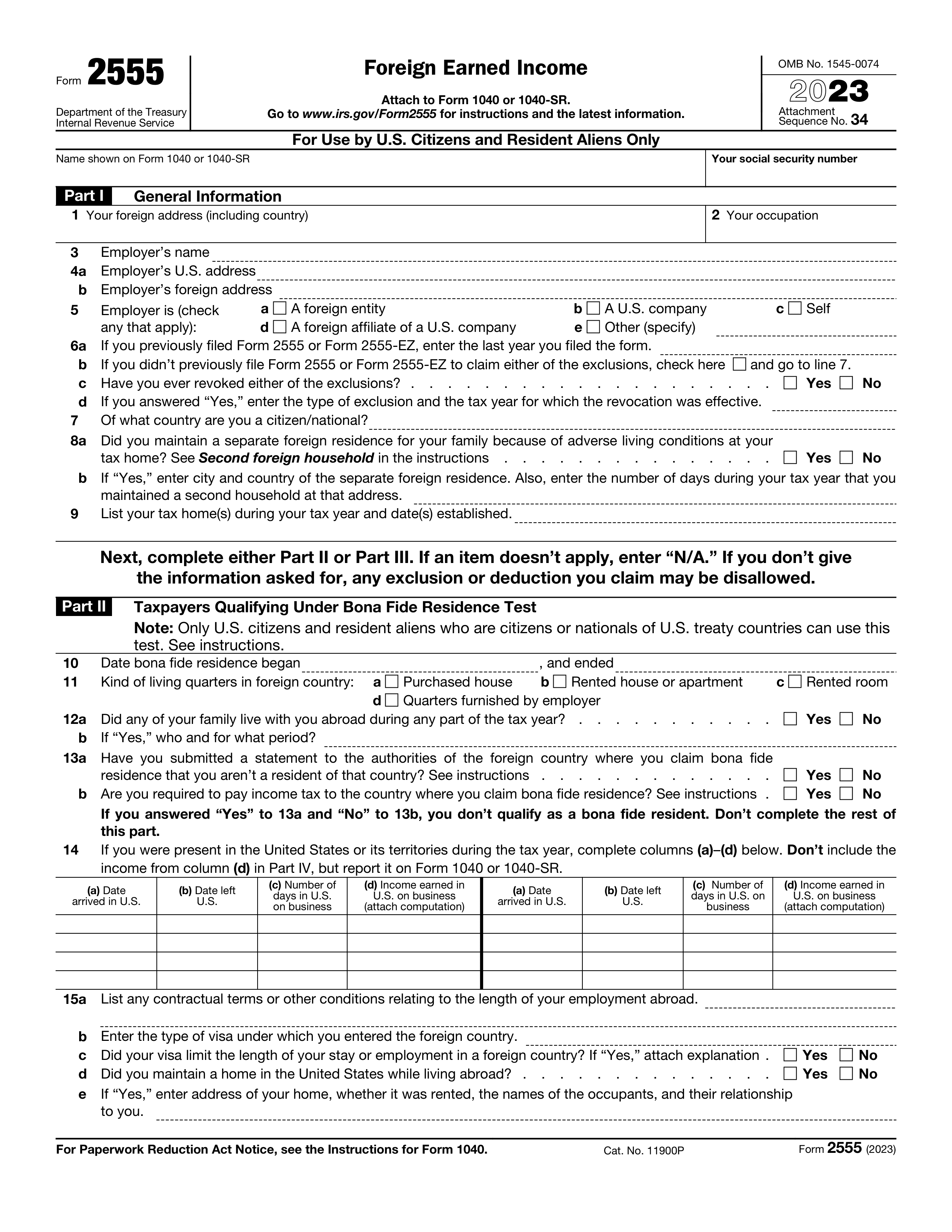

He marketed his U.S. home to develop his intent to live abroad completely and applied for a Mexican residency visa with his better half to help satisfy the Bona Fide Residency Examination. Neil aims out that purchasing residential property abroad can be testing without initial experiencing the area."We'll absolutely be outdoors of that. Also if we come back to the United States for medical professional's consultations or service phone calls, I doubt we'll invest more than 30 days in the US in any provided 12-month duration." Neil highlights the value of stringent tracking of U.S. check outs (Form 2555). "It's something that individuals require to be truly diligent regarding," he states, and encourages deportees to be cautious of common errors, such as overstaying in the united state

3 Simple Techniques For Feie Calculator

tax obligation commitments. "The reason that U.S. tax on around the world income is such a large deal is because lots of people forget they're still based on united state tax also after relocating." The united state is one of the couple of nations that tax obligations its residents regardless of where they live, meaning that even if a deportee has no income from united statetax obligation return. "The Foreign Tax obligation Debt enables individuals operating in high-tax nations like the UK to offset their united state tax obligation obligation by the quantity they have actually already paid in tax obligations abroad," says Lewis. This ensures that deportees are not tired two times on the very same revenue. Those in low- or no-tax countries, such as the UAE or Singapore, face additional hurdles.

The smart Trick of Feie Calculator That Nobody is Talking About

Below are a few of one of the most frequently asked inquiries about the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) allows united state taxpayers to omit as More hints much as $130,000 of foreign-earned earnings from federal revenue tax, reducing their U.S. tax obligation liability. To get FEIE, you should meet either the Physical Existence Examination (330 days abroad) or the Bona Fide House Examination (prove your key residence in a foreign country for an entire tax obligation year).

The Physical Visibility Examination also requires United state taxpayers to have both a foreign income and an international tax obligation home.

How Feie Calculator can Save You Time, Stress, and Money.

A revenue tax obligation treaty in between the united state and an additional country can assist avoid dual tax. While the Foreign Earned Income Exclusion lowers gross income, a treaty might supply additional benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed declare united state people with over $10,000 in international monetary accounts.Eligibility for FEIE relies on conference specific residency or physical visibility tests. is a tax obligation expert on the Harness system and the creator of Chessis Tax. He is a participant of the National Association of Enrolled Representatives, the Texas Culture of Enrolled Brokers, and the Texas Society of CPAs. He brings over a years of experience benefiting Huge 4 firms, recommending migrants and high-net-worth individuals.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation expert on the Harness platform and the founder of The Tax Dude. He has more than thirty years of experience and now specializes in CFO services, equity settlement, copyright tax, marijuana taxes and divorce related tax/financial planning matters. He is an expat based in Mexico - https://hearthis.at/feiecalcu/set/feie-calculator/.

The foreign earned earnings exemptions, occasionally referred to as the Sec. 911 exemptions, omit tax obligation on salaries gained from functioning abroad. The exclusions consist of 2 parts - an earnings exclusion and a housing exclusion. The following FAQs go over the benefit of the exclusions consisting of when both partners are expats in a basic fashion.

Some Known Facts About Feie Calculator.

The earnings exclusion is currently indexed for rising cost of living. The maximum yearly income exemption is $130,000 for 2025. The tax obligation benefit excludes the income from tax obligation at lower tax prices. Formerly, the exclusions "came off the top" decreasing revenue topic to tax at the leading tax prices. The exemptions may or might not reduce revenue utilized for other functions, such as IRA limits, child credit ratings, personal exceptions, etc.These exclusions do not exempt the wages from United States tax however just supply a tax obligation reduction. Keep in mind that a bachelor functioning abroad for every one of 2025 that made about $145,000 without any other revenue will certainly have gross income decreased to zero - efficiently the very same response as being "tax obligation free." The exemptions are calculated on a daily basis.

Report this wiki page